Ultimate California Living Trust Estate Plan

No traffic. No office visits. No wasted time. Just two simple, private, and affordable ways to take control of your future and protect the people you care about.

We created an estate planning solution built around how how life actually works. You can create your living trust and estate plan while sitting at the kitchen table at home. All you need is your phone or laptop.

No traffic. No office visits. No wasted time. Just a simple, private, and affordable way to take control of your future and protect the people you care about and love.

Here’s why we did this. For most people, estate planning feels like a maze of paperwork and lawyer talk. Our two options do not. In addition to all the free bonuses, our California living trust based estate plan give you a clear, attorney-backed path to protect your home, your assets, and the people you love without stepping foot in an office or courtroom. Built specifically for California families, they are private, affordable, and personal from start to finish. You can complete everything from your living room with expert guidance and zero guesswork. This is how you protect your legacy—with confidence, not confusion.

Benefits of a Revocable Living Trust

Our two estate plans both include a revocable living trust. There’s a reason for that. It’s the backbone of a smart, secure plan—the one thing that holds everything else together.

We also focus on helping people, families, and small business owners with small to medium estates, those worth ten million dollars or less (most Californians), protect what they’ve built and ensure it passes smoothly to the next generation.

Our process is simple and personal. You can start and complete your entire estate plan from the comfort of your living room. No driving across town. No sitting in traffic. No awkward office visits. Just private, affordable, step-by-step guidance that fits your life and gives you confidence knowing everything’s handled the right way.

When you create a California living trust, you take control of your future and give your family the gift of clarity and peace. Here’s what a well-built living trust really gives you:

- Freedom from probate. No courts. No delays. Your loved ones get what you’ve built without the time, cost, and frustration of California’s probate process.

- Total privacy. Your assets, decisions, and family details stay out of the public record, where they belong—private and protected.

- Continuous management. If you ever become incapacitated, your chosen trustee steps in immediately to handle your affairs—no court intervention, no frozen accounts, no chaos.

- Speed and simplicity. Everything transfers to your loved ones faster and with less stress. The process is organized, straightforward, and guided by your exact instructions.

- Complete control. You decide who receives what, when, and how. You can delay inheritances until children or beneficiaries are ready, set conditions, and make sure your wishes are followed exactly.

- Protection for those who need it most. You can safeguard minors, loved ones with special needs, or anyone who may need extra guidance or structure.

- Coverage across states. If you own property in more than one state, your trust eliminates the risk of multiple probates and makes everything easier to manage.

- Strength and flexibility. Your trust is revocable—you can change it, update it, or cancel it whenever life changes. It adapts with you, not against you.

- Built-in security. A trust is harder to challenge than a will and can even define financial boundaries before or during marriage. You can also appoint a professional trustee if you want expert oversight.

- Confidence, comfort, and peace of mind. You stay in full control while you’re alive, you protect your family after you’re gone, and you leave behind order instead of confusion.

That’s what real legacy planning looks like—simple, strong, and built to last.

Without An Estate Plan

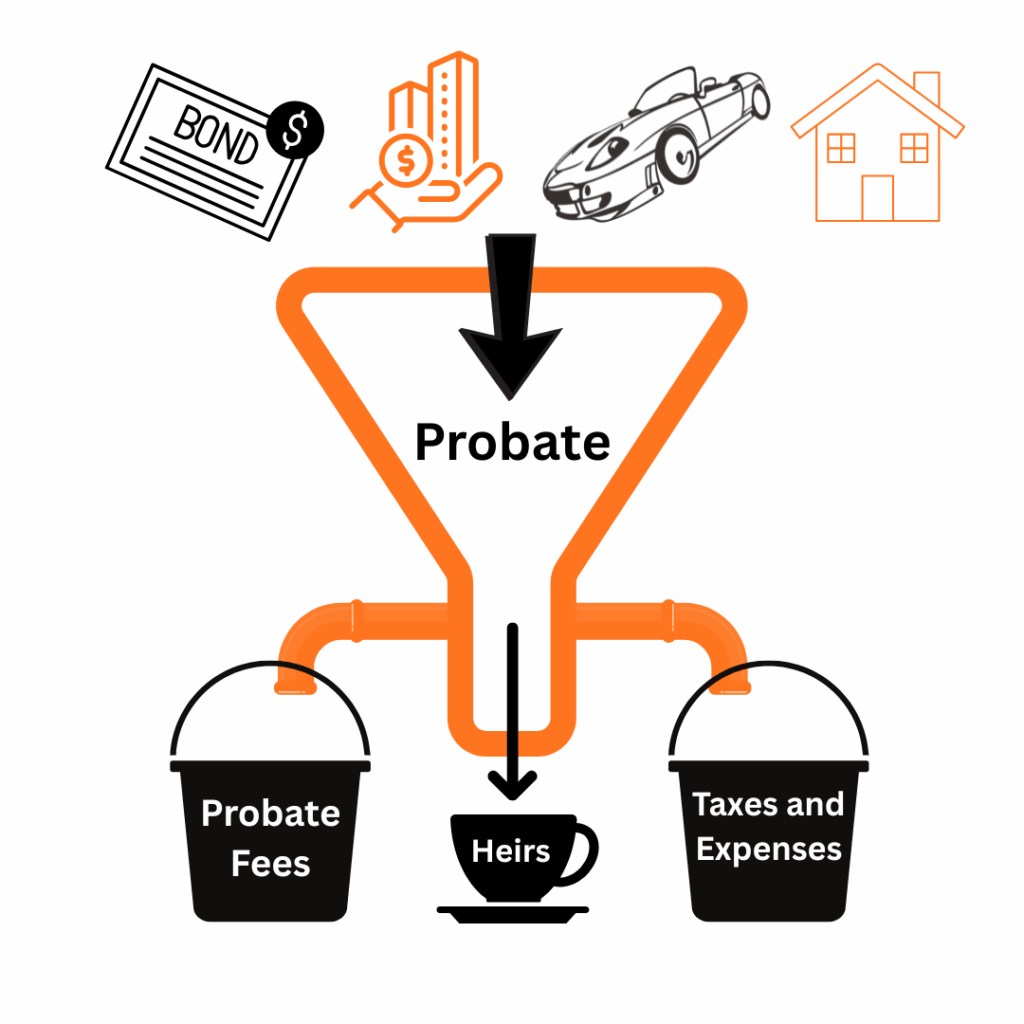

The Problem with Probate

Most Californians don’t realize that without the right living trust in place, their estate will be forced into probate. If you’re relying on a simple Will—or have no estate plan at all—the court takes control. That means long delays, extra fees, and unnecessary taxes that eat away at what you’ve built. In the end, your family receives less, not because of bad luck, but because the system steps in and takes its share first.

For example, in California the combined statutory fees for attorneys and executor in probate are:

Estate Value

$100,000- The combined fees for attorney and executor are approximately $8,000

$200,000- The combined fees for attorney and executor are approximately $14,000

$500,000- The combined fees for attorney and executor are approximately $26,000

$1,000,000- The combined fees for attorney and executor are approximately $46,000

$2,000,000- The combined fees for attorney and executor are approximately $66,000

$5,000,000- The combined fees for attorney and executor are approximately $126,000

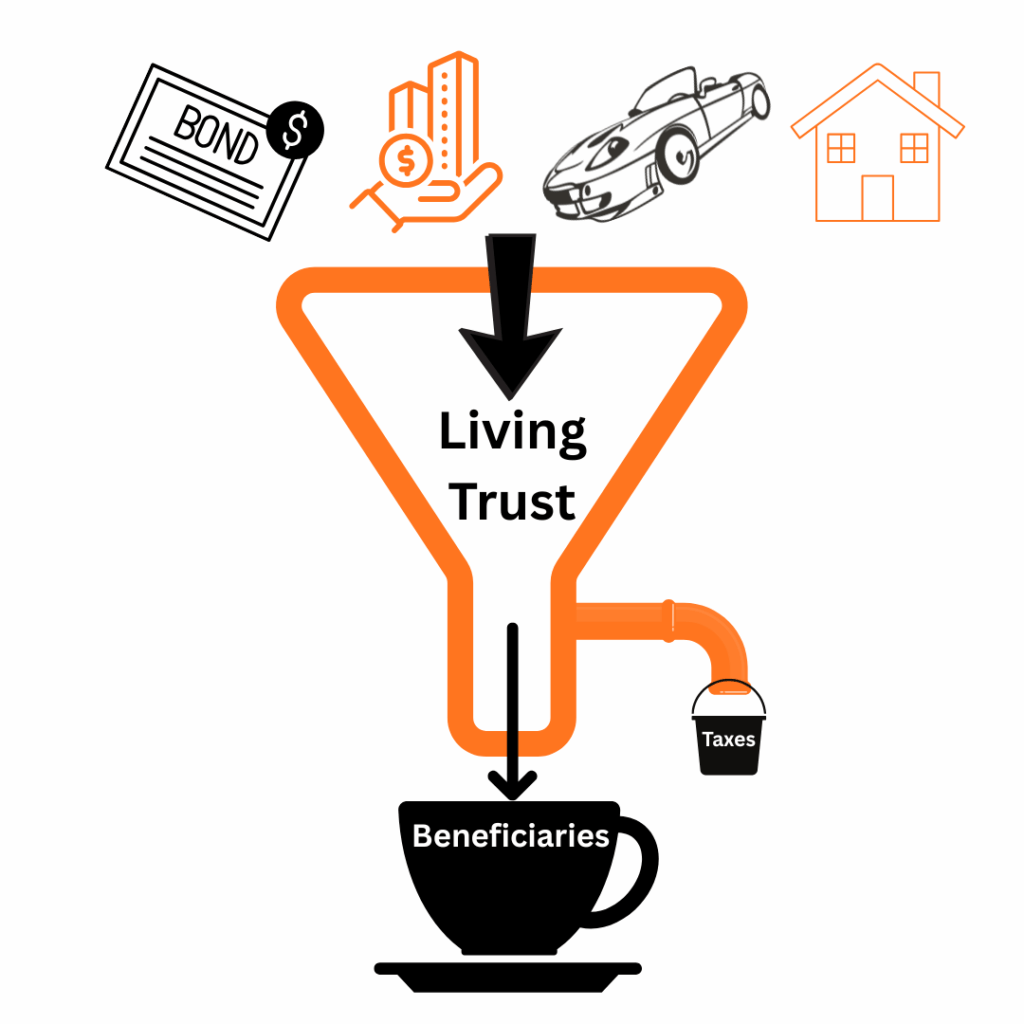

With Our California Living Trust Estate Plan

When your assets are titled in your living trust, they skip probate completely and go straight to the people you love. Sure, final income taxes still have to be paid, but the right plan can cut or even wipe out estate taxes altogether. The rest stays where it belongs—with your family.

Two Simple Ways to Protect Your Family and Create Your California Living Trust Online

Our pricing is simple, clear, and upfront—no surprises, no hidden fees, no fine print.