Ultimate California Living Trust Estate Plan

No traffic. No office visits. No wasted time. Just two simple, private, and affordable ways to take control of your future and protect the people you care about.

Imagine This

It’s a quiet Sunday morning. The house smells like coffee, sunlight spills across the kitchen table, and for the first time in weeks you feel at peace. You know exactly where everything stands—your home, your savings, your business, your family’s future. No loose ends. No court delays. No guessing what happens next.

That calm didn’t come from luck. It came because you made a decision. You took control, protected your loved ones, and built a plan that works when life doesn’t go according to plan.

That’s what a California living trust does. It’s not just paperwork, it’s protection, privacy, and peace of mind wrapped into one.

The Problem Most Families Never See Coming

Every week we meet good, responsible people who thought they had everything covered. They wrote a will years ago. Maybe they added their spouse to the deed. Maybe they told their kids, “Don’t worry, it’s all in writing.”

Then someone passes or becomes incapacitated—and everything changes.

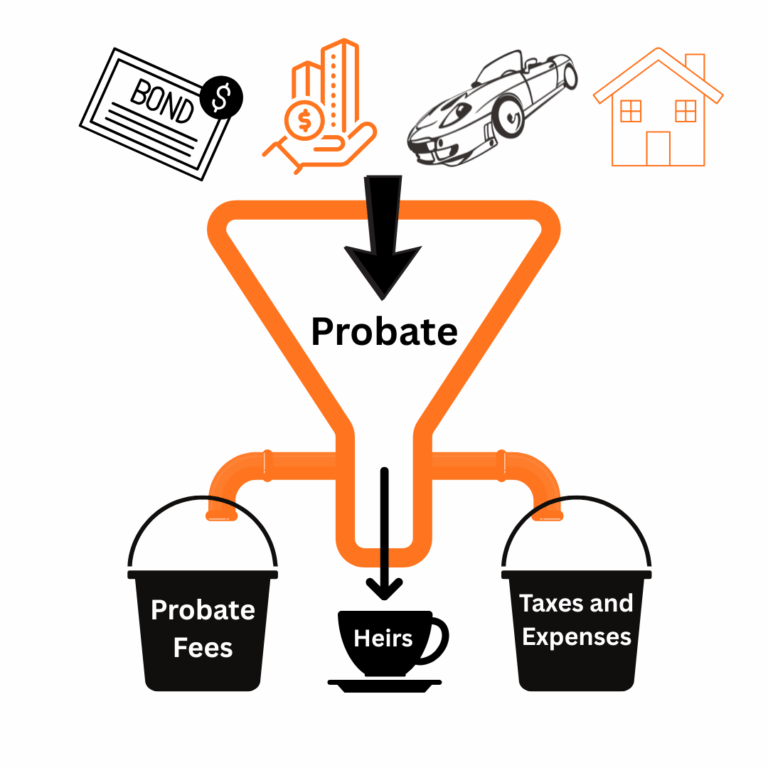

Suddenly the court steps in. Probate begins. The family waits months or even years while lawyers and executors take their fees first. Private details become public. Property sales get delayed. Emotions run high.

And the people left behind, the very people you meant to protect, find themselves tangled in a system that takes time, money, and control away from them.

In California, the average probate on a modest estate can take more than a year and cost tens of thousands of dollars in mandatory attorney and executor fees.

How Are Your Assets Valued During Probate?

In California, the value of a probate estate is based on the total fair market value of all assets that are subject to probate—not what you owe on them. In other words, it’s the gross value of probate assets, not the net value after debts or mortgages.

Here’s what the court includes when calculating that value:

- Real estate titled in your name alone — homes, land, or investment property not held in a trust or joint ownership.

- Bank and credit union accounts — checking, savings, and CDs held solely in your name without a payable-on-death (POD) or transfer-on-death (TOD) beneficiary.

- Investment accounts — brokerage accounts, stocks, and bonds titled only in your name without a beneficiary designation.

- Personal property — jewelry, artwork, collectibles, vehicles, boats, and other tangible assets of significant value.

- Business interests — ownership in an LLC, corporation, or partnership held in your name personally.

- Life insurance or retirement accounts without a named beneficiary — if no beneficiary is listed or if all named beneficiaries are deceased, those proceeds become part of the probate estate.

- Notes, loans, or money owed to you — promissory notes or unpaid debts where you’re the creditor.

Probate does not count assets that already have a legal way to transfer outside of court, such as:

- Assets held in a revocable living trust

- Property owned as joint tenancy or community property with right of survivorship

- Accounts with designated beneficiaries (like IRAs, 401(k)s, or life insurance)

- Assets with transfer-on-death or payable-on-death designations

So, for example, if your home is worth $800,000 but has a $400,000 mortgage, the court still counts it as an $800,000 asset for probate purposes. That’s why even modest estates often cross California’s $184,500 small-estate limit and end up in full probate—unless you plan ahead with a living trust.

Here’s the Current Schedule of Mandatory Fees/Expenses (you can avoid):

- $100,000 estate → about $8,000

- $500,000 estate → about $26,000

- $1,000,000 estate → about $46,000

- $2,000,000 estate → about $66,000

- $5,000,000 estate → about $126,000

That’s money that should stay with your family — not the court.

There’s a Better Way

Our firm’s two California Living Trust Estate Plans exist so that you never have to put your loved ones through that.

Our solutions are a digital-first, attorney-backed estate planning options designed specifically for California families and small business owners with estates up to ten million dollars (most people and families in California). You can create your living trust and estate plan while sitting at the kitchen table at home. All you need is your phone or laptop.

No traffic. No office visits. No wasted time. Just a simple, private, and affordable way to take control of your future and protect the people you care about and love.

We also want you to know that our solutions are not a one-size-fits-all kit. They are each guided paths, built by professionals who understand both the law and real life.

What You Gain

When you create a California living trust, you take control of your future and give your family the gift of clarity and peace. Here’s what a well-built living trust really gives you:

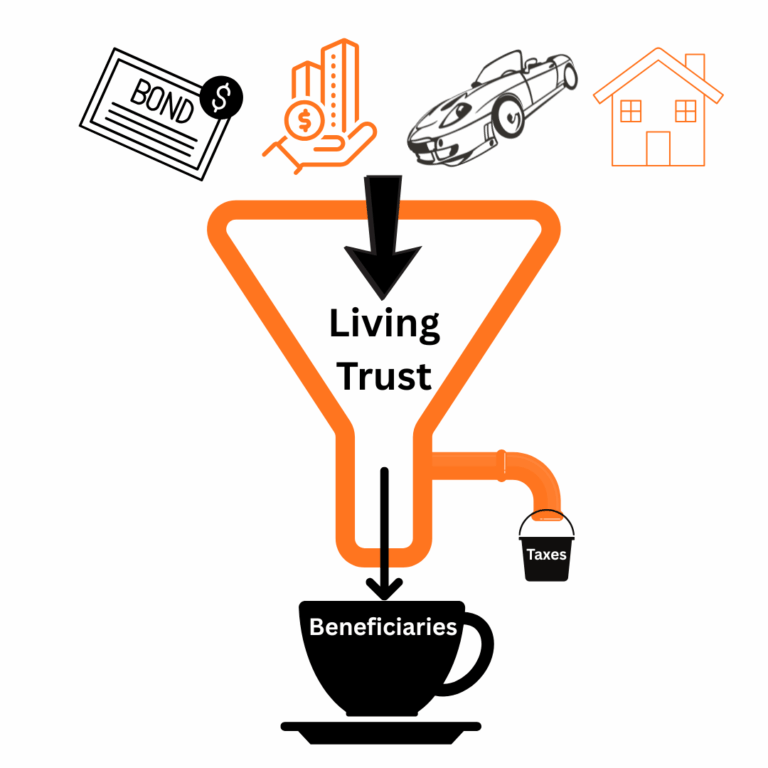

- Freedom from probate. No courts. No delays. Your loved ones get what you’ve built without the time, cost, and frustration of California’s probate process.

- Total privacy. Your assets, decisions, and family details stay out of the public record, where they belong—private and protected.

- Continuous management. If you ever become incapacitated, your chosen trustee steps in immediately to handle your affairs—no court intervention, no frozen accounts, no chaos.

- Speed and simplicity. Everything transfers to your loved ones faster and with less stress. The process is organized, straightforward, and guided by your exact instructions.

- Complete control. You decide who receives what, when, and how. You can delay inheritances until children or beneficiaries are ready, set conditions, and make sure your wishes are followed exactly.

- Protection for those who need it most. You can safeguard minors, loved ones with special needs, or anyone who may need extra guidance or structure.

- Coverage across states. If you own property in more than one state, your trust eliminates the risk of multiple probates and makes everything easier to manage.

- Strength and flexibility. Your trust is revocable—you can change it, update it, or cancel it whenever life changes. It adapts with you, not against you.

- Built-in security. A trust is harder to challenge than a will and can even define financial boundaries before or during marriage. You can also appoint a professional trustee if you want expert oversight.

- Confidence, comfort, and peace of mind. You stay in full control while you’re alive, you protect your family after you’re gone, and you leave behind order instead of confusion.

That’s what real legacy planning looks like—simple, strong, and built to last.

That’s more than a document—it’s peace of mind you can feel.

Option One: The 30 Minute Do-It-Yourself California Living Trust Plan ($999)

This is for people who want full control and step-by-step guidance without the added cost of attorney time.

You click the link below and start filling out a secure online questionnaire. Take your time.

As you work your way through the questions, your personalized plan begins taking shape. The system walks you through every choice and provides instant access to all the essential documents California law requires to protect your family and assets.

When you’re finished and make your secure online payment, you receive:

- Your personalized California Revocable Living Trust (normally valued at $2,500)

- A Pour-Over Will that works seamlessly with your trust (valued at $750)

- A Durable Power of Attorney for Assets (valued at $450)

- A California Advanced Health Care Directive (valued at $450)

You also get a private digital vault to safely store, update, and share your documents whenever you need them.

Total value: $4,150.

Your price: $999.

That’s an immediate $3,151 in savings—and the ability to complete your entire plan in less than an hour, or over the next few days if you want to take your time.

This option is perfect for organized families who want to handle things themselves with clear, attorney-designed guidance every step of the way.

Option Two: The Attorney-Assisted Ultimate California Living Trust Estate Plan ($3,500)

If you want a seasoned California estate planning attorney personally guiding your family’s plan from start to finish, this is for you.

You get everything in Option One plus complete attorney support, expert recommendations, and personalized legal oversight.

Simply use the link to contact us and let us know you’d like to move forward, and we’ll take it from there.

This plan includes:

Ultimate California Living Trust (normally $2,500 value)

Bonus #1: Pour-Over Will ($750 value)

Bonus #2: Certificate of Trust ($150 value)

Bonus #3: Financial Power of Attorney ($450 value)

Bonus #4: California Advanced Health Care Directive ($450 value)

Bonus #5: Initial private Zoom or phone meeting with Attorney Mitch Jackson ($800 value)

Bonus #6: Asset Protection Review and Recommendations ($800 value)

Bonus #7: Annual First-Year Review Meeting ($400 value)

Bonus #8: Assistance with Optional Digital Vault Setup ($400 value)

Bonus #9: “How To” Trust Funding Instructions ($200 value)

Bonus #10: AI Accuracy Check of Your Plan ($300 value)

Bonus #11: Audio Overview of Your Estate Plan ($300 value)

Bonus #12: Free Email and Text Questions for 30 Days ($400 value)

Total value: $7,900.

Your price: $3,500.

You save $4,400—and gain direct access to expert legal guidance and personal support from start to finish.

We limit the number of new Ultimate clients each month to maintain personal service. Once those spots are filled, pricing returns to the full rate.

What’s Included in Both Options

Each of our California Living Trust Estate Plan options give you everything you need to protect your family and your future. You’ll get a complete set of core legal documents built for real life in California—a customized revocable living trust, a pour-over will, a durable power of attorney for finances, and an advanced health care directive that keeps you in control when it matters most.

If you choose the Attorney-Assisted Ultimate Plan, you’ll get everything above plus several thousand dollars of free bonuses. We’re talking about phone and Zoom meetings with our lawyers, a full asset protection review, clear written trustee instructions, your first-year review meeting, a secure digital vault setup, and more.

Option One, our Do-It-Yourself Plan, is just $1,500. Option Two, the Attorney-Assisted Ultimate Plan, carries a total value of $7,900—but right now, a limited number of clients each month can lock it in for $3,500.

Why Trust Us

We have spent more than three decades as award winning California lawyers helping families and small business owners protect what they’ve built. We’ve seen what happens when people plan right and what happens when they don’t.

Our process was built to save you from the confusion, cost, and family drama. It blends proven legal expertise with the ease of modern technology — so you can finally check this off your list and feel confident it’s done right.

We serve California residents only, because state laws are unique—and your plan deserves to follow them precisely.

Testimonials

Addressing What You Might Be Thinking

“I already have a will.”

That’s a good start, but wills still go through probate in California. A living trust avoids it entirely.

“I don’t own much yet.”

If you own a home, have a savings account, or even a small business, you already have enough to protect. The sooner you plan, the more you save.

“It sounds expensive.”

Not compared to probate. On a $500,000 estate, probate fees alone average $26,000. Furthermore, our estate planning fees are reasonable and affordable. Your full trust plan costs a fraction of what probate takes.

“I can always do it later.”

Later is how most families end up in court. The truth is, no one knows when later becomes too late.

The Difference Between Waiting and Acting

If you wait, the state of California decides what happens to your property, your business, and even who cares for your minor children.

If you act now, you decide.

And once it’s done, you can breathe easier knowing your family will never be stuck in court, fighting over what should have been simple.

It’s time to protect your family.

Our Do-It-Yourself plan is fast, easy and depending on how organized you are, can be done in an hour or if you want to take your time, the next few days.

If you’re thinking about our Attorney-Assisted Ultimate California Living Trust Estate Plan, please remember that we limit the number of plans we accept each month to maintain personal attention for every client.

If you want to lock in the discounted $3,500 rate and start your plan this week, now is the time to act.

The Future You’re Building

Picture this again. It’s that same quiet Sunday morning. Your loved ones are gathered around the kitchen table, not sorting through papers or arguing over court forms, but smiling—because you made things clear, simple, and fair.

You didn’t leave them a burden. You left them a legacy.

That’s the power of a California living trust done right.

Your Next Step

Choose the option that fits you best:

Do-It-Yourself California Living Trust Plan – $999

Complete your plan online, on your time, with full support and zero confusion.

Attorney-Assisted Ultimate California Living Trust Estate Plan – $3,500

Also complete your plan online but get expert guidance from start to finish, personalized to your life and goals. Click the link, send a message that you’re interested, and we’ll take it from there.

Both plans protect your family. Both save you time and money. The only question is how much help you want along the way.

You’ve worked too hard to let the court decide what happens next.

Take control. Protect your family. Build your legacy.

Warm regards,

Mitch Jackson

Attorney, Mediator, Consultant, Speaker, and Writer

Jackson & Wilson, Inc.

P.S. Your future doesn’t get stronger by waiting. It gets stronger the moment you decide to protect what you’ve built and give your family clarity instead of chaos. If you’re ready for a plan that keeps your loved ones out of court and puts you in control, start today. Your peace of mind is one decision away.

More Resources

Our YouTube channel is the single most authoritative, frictionless, AI accurate digital-first hub for California families wanting straight and accurate answers to their estate planning and living trust questions.

Every video is about value, not hype. You’re getting practical, real-world estate planning advice from award-winning California lawyers who’ve been helping families for more than 30 years.

If you have a problem with the AI avatars, just close your eyes and listen. Nothing on YouTube comes close to giving you this level of information. Full stop.

We’re full-time lawyers, not content creators. We’re in meetings, in conferences, and in court every day helping real people solve real problems. That’s why we’re leveraging the power of AI avatars to share what we know faster and more consistently. This technology lets us help you while we stay focused on what matters most, protecting our clients and their families.

__________

Weekly Live Video: The California Estate Planning Conversation You Don’t Want to Miss